pay utah corporate tax online

The penalties are a percentage of the unpaid tax based on the number of days late. Payments can be made online by e-check ACH debit at taputahgov.

Can You Go To Jail For Not Paying Your Taxes Tax Lawyer Tax Attorney Filing Taxes

Please contact us at 801-297-2200 or.

. This section discusses methods for filing and paying your taxes including how to file onlinethe fastest and safest way to file. The loss carryback is subject to a 1000000 limitation. Employment Taxes and Fees.

File a Form 606 eResponse File a Form 613 or 613-R. Utahs corporate income tax is a business tax levied on the gross taxable income of most businesses and corporations registered or doing business in Utah. Visit Utahgov opens in new window Services opens in new window Agencies opens in new.

Please contact us at 801-297-2200 or. Pay Utah Corporate Tax Online online utah Edit. You will receive your tax license information by postal mail after which you can go to Taxpayer Access Point taputahgov and create a TAP login to file and pay your taxes online.

Filing Paying Your Taxes. You have two options for filing and paying your Utah sales tax. View History of 613 Responses.

A C corporation filing form TC-20 may be entitled to carry back a current-year loss against income of the previous three years. A corporation that had a tax liability of 100 the minimum tax for the previous year may prepay the minimum tax amount of 100 on the 15th. You can also pay online and.

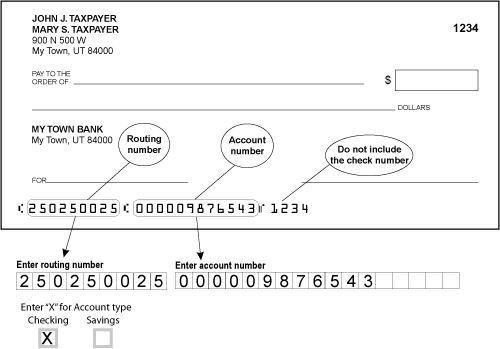

It does not contain all tax laws or rules. Your business may be required to file information returns to report. What you need to pay online.

Utah Taxpayer Access Point TAP TAP. Utah Dixie Rentals Rental Property Investment Real Estate Investing Rental Property Being A Landlord. Ad Submit Your Utah Dept of Revenue Payment Online with doxo.

Please note that our offices will be closed November 25 and November 26 2021. You may pay your tax online with your credit card or with an electronic check ACH debit. View All New Hire Options.

To pay business personal property taxes. Pay directly to the Utah County Treasurer located at 100 E Center Street Suite 1200 main floor Provo UT. TAP includes many free services such as tax filing and payment and the ability to manage your account online.

Unemployment Insurance administered by the. View All Claims Options. The corporate income tax in Utah.

See also Payment Agreement Request. The Utah corporate income. After a sales tax license has been issued the Tax.

Taxpayer Access Point TAP Register your. File electronically using Taxpayer Access Point at. Ad Submit Your Utah Dept of Revenue Payment Online with doxo.

Generally if you apply online you will receive your ein immediately. Pay Utah Corporate Tax Online. Pay directly to the utah county treasurer located at 100 e center street suite 1200 main floor provo ut.

A corporation that had a tax liability of 100 the minimum tax for the previous. All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov. Online payments may include a.

The penalty for underpaying an extension prepayment is 2 percent of the unpaid tax per month of the. File and Pay Online. You may also need.

For security reasons TAP and other e-services are not available in most countries outside the United States. Pay Utah Property Tax Online. Like nearly every other state Utah requires corporations to pay a corporate income tax which is also referred to as the corporation franchise and income tax.

Utahs Taxpayer Access Point. Create a New UI. How to File and Pay Sales Tax in Utah.

The self-employment tax is a social security and Medicare tax for individuals who work for themselves. For security reasons TAP and other e-services are not available in most countries outside the United States. Skip to Main Content.

It does not contain all tax laws or rules. If you pay Utah wages to Utah employees you must have a Withholding Tax license.

Child Support Liens In Utah What You Need To Know Child Support Child Support Laws Supportive

Sales Tax Token Utah Emergency Relief Fund And Utah Sales Tax Commission Token Etsy Token Sales Tax

![]()

Utah Income Taxes Utah State Tax Commission

State Corporate Income Tax Rates And Brackets Tax Foundation

New Jersey Income Tax Calculator Smartasset Income Tax Income Tax Return Federal Income Tax

Dba Corporations Utah Gov Business General Partnership Corporate

Investing In The Future Of Utah Premium Wordpress Themes Investing Wordpress Theme

Pay Taxes Utah County Treasurer

Corporate Retention Recruitment Business Utah Gov

Which States Pay The Highest Taxes Business Tax Family Money Saving Economy Infographic

Median Household Income And Taxes State Tax Levels In The United States Wikipedia Ricevimenti Valutazione

Collective Review An Honest Review Of The S Corp Back Office Tax Platform Tax Services Graphic Design Tips Tax Time

Stock Assignment Paper Issued By Whitney Company Of Salt Lake City Utah Old Stock Certificate Royal Uranium Corporat Assignments Salt Lake City Utah Whitney

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Utah Business Corporate Law Attorney Coulter Law Group Business Law Business Tax Small Business Law